does idaho have capital gains tax

In simple terms whether you sell a stock or receive a dividend you. The sales tax rate in Idaho is currently 6.

Idaho Pushes Back Filing Deadline For Income Taxes To Meet Federal Extension East Idaho News

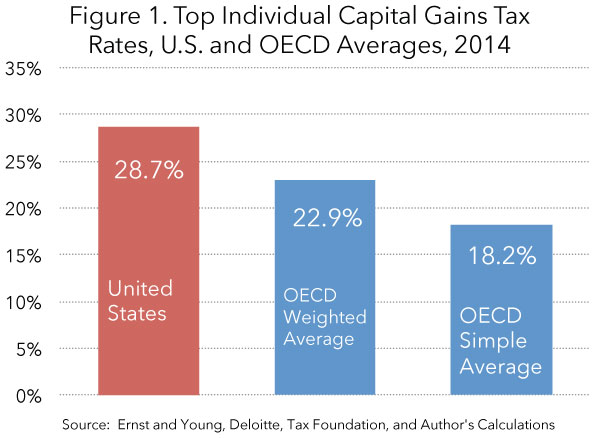

In Idaho the uppermost capital gains tax rate was 74 percent.

. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. Section 63-105 Idaho Code Powers and Duties - General Income Tax. The Idaho Income Tax.

States have an additional capital gains tax rate between 29 and 133. Dont include gains and. Up to 15 cash back Experience.

Does idaho have capital gains tax on. 2021 capital gains tax calculator. Uppermost capital gains tax rates by state 2015 State State uppermost rate.

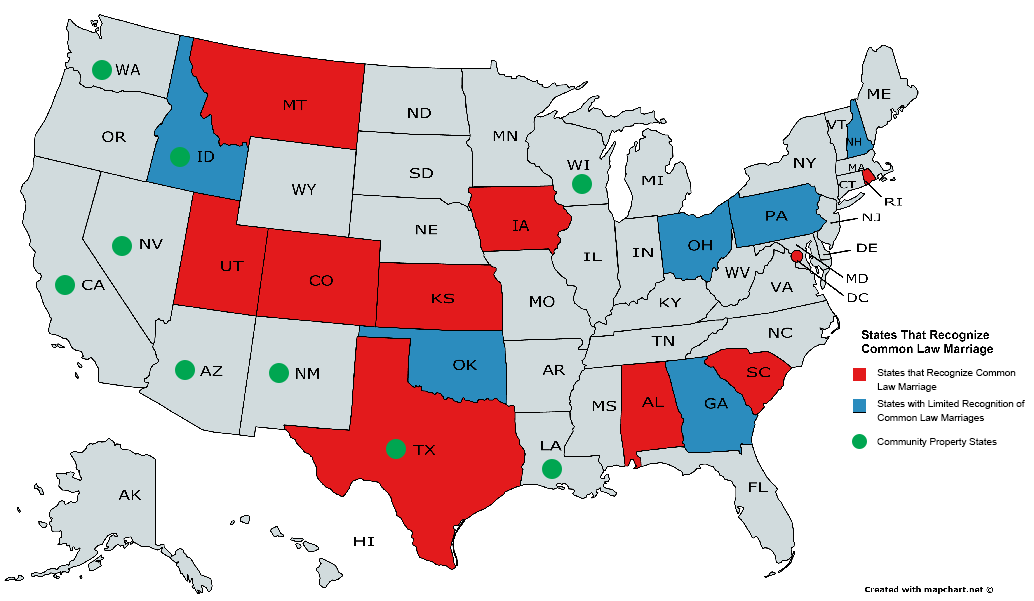

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 2022 capital gains tax rates. Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles.

Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single. The land in Idaho originally cost 550000. 18 hours agoA senior citizen is not required to pay any advance tax if heshe does not have any income taxable under the head Profits and gains from business or profession.

These would just be taxed as normal income. A majority of US. If you found this answer helpful please press the.

Right off the bat if you are single they will allow you to exclude 250000 of capital gains. Capital gains taxes on. One important thing to know about Idaho income taxes.

The rates listed below are for 2022 which are taxes youll file in 2023. The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed.

Idaho State Tax Commission. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more. The land in Utah cost 450000.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Understanding Capital Gains Tax On Real Estate Investment Property

Idaho State Tax Software Preparation And E File On Freetaxusa

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

State Taxation As It Applies To 1031 Exchanges

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Gold Silver Bullion Laws In Idaho

1031 Exchange Idaho Capital Gains Tax Rate 2022

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Idaho Tax Forms And Instructions For 2021 Form 40

1031 Exchange Idaho Capital Gains Tax Rate 2022

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Estimator East Idaho Wealth Management

Historical Idaho Tax Policy Information Ballotpedia

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Biden Plan To Exempt Farms From Elimination Of Capital Gains Tax Breaks Northern Ag Network